Many home borrowers have been caught off guard since May this year as the reserve bank governor, Philip Lowe, continues his fight against inflation - by rising interest rates at record levels.

Since May this year, the reserve bank base interest rate has increased from 0.1% to 2.6% - a rise of 2.5%.

For 4 months we had 0.5% increases and for 2 months we had 0.25% increases.

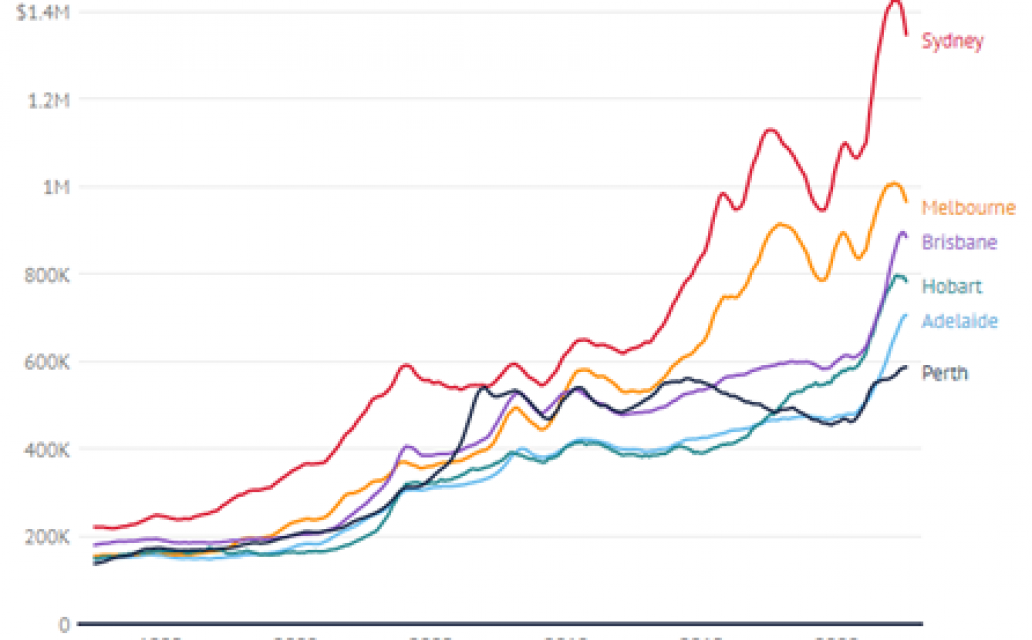

Naturally this has had a stifling effect on what many people describe as a runaway real estate market. For the 2 years during Covid, real estate was growing on average by 20% per annum, yet this type of growth was unsustainable and was fueled by the lowest interest rates in history.

The effect is a downward trend in property prices. There is an old saying in real estate, when the price of money goes up, the price of property goes down. To date, property prices have peeled back by approximately by 15% and 20% in some areas of Sydney. This was expected and predicted by many property analysts.

The current market conditions are much easier for buyers and sellers to transact in. During the last quarter, NGFarah have sold in excess of $181MIL worth of property – totaling 108 sales with an auction clearance rate of 76%, proving that housing demand has remained steady in Australia’s biggest City.

There are more opportunities for buyers as prices have become a little more affordable. In relation to the 10-year trend, since 2012 we are still close to the peak which means vendors selling today are still getting good prices, even though it is not the peak of the market.

Property values will remain steady and in big demand as the rental market explodes. There is a massive shortage of rental properties, which we will result in rent increases in the next 3 years.

This is a good sign for property owners and potential property investors.

Share This Post

Archived Posts

- March 2024 (2)

- December 2023 (1)

- May 2023 (1)

- February 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- May 2022 (1)

- March 2022 (1)

- November 2021 (2)

- September 2021 (1)

- August 2021 (2)

- June 2021 (1)

- May 2021 (2)

- April 2021 (1)

- March 2021 (1)

- February 2021 (2)